Mn Charitable Gambling Rules

- Minnesota Charitable Gambling Laws

- Mn Gambling Rules And Regulations

- Mn Charitable Gambling Rules

- Mn Charitable Gambling Laws

Charitable organizations, charitable trusts, and professional fundraisers generally must register and file periodic reports with the Minnesota Attorney General’s Office. For more information on these requirements, see Registration and Reporting - Charities and Charitable Trusts and Registration and Reporting - Professional Fundraisers. In addition, all nonprofits generally must provide prior notice of certain asset transfers, consolidations, mergers, conversions, and dissolutions. For more information on these requirements, see Information for Nonprofits. Below are links to the forms (including instructions) for use in complying with these registration, reporting, and notice requirements.

Minnesota Charitable Gambling Laws

Please use the Initial Registration Form if this is your first registration with the Minnesota Attorney General’s Office.

Charitable Organizations

Charitable Organization - Initial Registration

Charitable Organization - Annual Report Form

State of Minnesota Supplement to Unified Registrations - Initial Registration

State of Minnesota Supplement to Unified Registrations - Annual Reporting

Charitable Organization - Exemption Form

Extension Request

Change of Address Form

Charitable Trusts

Charitable Trust - Initial Registration

Charitable Trust - Annual Report

Charitable Trust - Exemption Form

Court Supervised Charitable Trust - Annual Accounts Summary

Extension Request

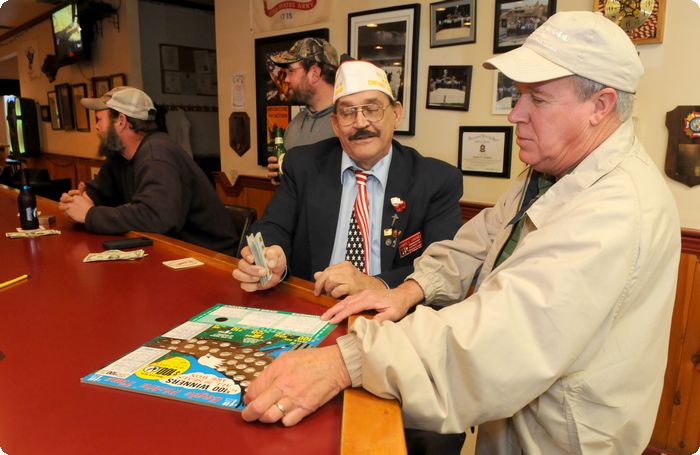

According to the Gambling Control Board, the sale of pulltabs, bingo, paddlewheels, raffles and tipboards exceeded $2 billion in 2018, with $1.6 billion paid out in prizes. After prizes, expenses, and state gambling taxes were paid, over $83 million was available for charitable distribution. The bills approved are. (5) a private social bet not part of or incidental to organized, commercialized, or systematic gambling; (6) the operation of equipment or the conduct of a raffle under sections 349.11 to 349.22, by an organization licensed by the Gambling Control Board or an organization exempt from licensing under section 349.166. GENERAL STATEMENT OF NEED AND REASONABLENESS In an effort to improve the regulation of charitable gambling in this state, the Minnesota Charitable Gambling Control Board (Board) proposes minor amendments to the rules governing charitable gambling. Charitable Gambling Manager introduces a whole new way to do things. What you used to do by hand, what you used to be on paper, and what used to be scattered (and stuck!) at various locations all over town can now be automated, securely stored digitally, and be always at your fingertips. Minnesota Gambling Control Board Rules. The rules for lawful gambling electronic games, sports tipboard games, and other lawful gambling provisions are effective on Monday, July 15, 2019. For those of you affected by language requiring compliance within 180 days from the effective date of the rules, that date is January 11, 2020.

Professional Fundraisers

Professional Fundraiser Registration Statement

Professional Fundraiser Solicitation Notice

Professional Fundraiser Solicitation Campaign Financial Report

Professional Fundraiser Bond

Professional Fundraiser Bond Continuation Certificate

All Nonprofit Entities

Notice of Intent to Dissolve, Merge, Convert, Consolidate, or Transfer Assets

How To Register and Report

Electronic Filing of Documents. Organizations may register and make all required filings by email. Organizations may submit required materials to the Attorney General’s Office at charity.registration@ag.state.mn.us. All materials submitted via email must be in PDF format and the subject line of the email must contain the organization’s legal name. Emails not following these requirements may not be properly processed, which could result in noncompliant registration and reporting.

Electronic Payment of Fees. Organizations may pay all required fees, including any late fees, electronically using the Attorney General’s Office’s Electronic Payment of Fees webpage. This electronic payment system has a self-directed, step-by-step process allowing charities to pay fees via credit or debit card through a dedicated webpage operated by U.S. Bank. Please note there is a nonrefundable processing fee charged by U.S. Bank for organizations that choose to pay required fees electronically.

Mn Gambling Rules And Regulations

Submissions/Payments by Mail. If organizations prefer, they may submit required materials by mail and pay required fees by check. Checks should be made payable to the “State of Minnesota.” Required documents and payments should be mailed to the following address:

Minnesota Attorney General’s Office

Charities Division

445 Minnesota Street, Suite 1200

St. Paul, MN 55101

Mn Charitable Gambling Rules

Organizations may contact the Minnesota Attorney General’s Office at (651) 757-1496 or (800) 657-3787 with any questions about registration and reporting.

Charities and charitable trusts that incorporate in Minnesota do so under the Minnesota Nonprofit Corporation Act, Minn. Stat. ch. 317A, or, less commonly, as a nonprofit limited liability company.(73) A summary of the Nonprofit Corporation Act is beyond the scope of this guide, but Minnesota nonprofits should be aware of certain key statutes in the Act, including the following:

- The length of time a director may serve on a nonprofit’s board may not exceed ten years without the person being elected or appointed to a new term. There is no limit on how many terms a director may serve on a board.(74)

- Nonprofit board members have various fiduciary duties imposed on them as a director of the nonprofit, including the duties of care, loyalty, obedience, and to act in the best interests of the organization, among others.(75)

- Nonprofit officers, or those exercising the functions of officers, likewise have various fiduciary duties imposed on them.(76)

- A nonprofit must satisfy certain criteria in order to properly transact business with a related party.(77)

- A nonprofit may not lend money to a director, officer, or employee of the organization (or a related organization) unless the board of directors reasonably expects the loan to benefit the nonprofit, as opposed to the recipient of the loan.(78)

- A nonprofit is required to maintain complete and accurate books and records regarding its operations and affairs, including its articles and bylaws, accounting records, voting agreements, and meeting minutes.(79)

Minnesota nonprofits should review the entirety of chapter 317A and consult with a private attorney to ensure their compliance with these laws. This Office has also prepared a brochure entitled 'Guide for Board Members: Fiduciary Duties of Directors of Charitable Organizations.' It discusses in more detail the roles and responsibilities of board members.

Mn Charitable Gambling Laws

The requirements imposed on nonprofits by statutes administered by the Minnesota Secretary of State and the Minnesota Gambling Control Board (for nonprofits that engage in charitable gambling) are not discussed in this guide. For more information on these matters, please contact the Minnesota Secretary of State, Retirement Systems of Minnesota Building, 60 Empire Drive, Suite 100, St. Paul, MN 55103, or at (651) 296-2803 or (877) 551-6767. For information regarding charitable gambling, please contact the Minnesota Gambling Control Board, 1711 West County Road B, Suite 300 South, Roseville, MN 55113, or at (651) 539-1900.